The Central Bank of Nigeria has finally concluded plans to release all N1,000, N500 and N200 notes in its custody to Deposit Money Banks, The PUNCH can report authoritatively.

This decision is expected to end months of hardships and pains Nigerians have been going through following a controversial CBN naira redesign policy that has caused a severe shortage of old and new naira notes across the country.

The CBN’s latest decision came several weeks after the Supreme Court ordered that old N1,000, N500 and N200 notes should remain legal tender until December 31, 2023.

On Wednesday night, top officials of the CBN and commercial banks confirmed to The PUNCH that the CBN Governor, Godwin Emefiele, had directed the DMBs to begin the disbursement of old N1,000, N500 and N200 notes to members of the public effective Thursday (today).

According to him, the CBN will also start releasing old notes to commercial banks from Thursday.

The PUNCH learnt Emefiele met with the chief executive officers of the DMBs on Wednesday evening where he told them that the central bank would start releasing all old notes in its custody to commercial banks effective Thursday (today).

Sources at the meeting said the CBN would also be cancelling all the controversial cash withdrawal limits it put in place in recent months.

Also, it was learnt the CBN would start by releasing crisp old notes to DMBS after which the ones deposited by commercial banks will also be released.

Furthermore, the CBN stated at the meeting that bank customers would no longer be required to generate any code before depositing their old notes.

One of the bank CEOs at the meeting, who spoke on condition of anonymity, said, “The CBN governor met with bank CEOs this evening virtually. It was a short meeting that lasted for just about 15 minutes. The governor said all old N1,000, N500 and N200 notes will be released to commercial banks beginning from Thursday. The CBN will start with crisp old notes after which the ones deposited by DMBs will be returned. The plan is to flood the economy with cash and ameliorate the challenges Nigerians have been passing through.“

Top bank chief

The top bank chief added, “Also, the CBN will be cancelling cash withdrawal limits it put in place recently. This means that individuals can now withdraw up to N500,000 across the counter while corporate bodies can do N5m. The CBN is expected to release a circular to this effect later tonight or tomorrow morning (today). But effectively, things should be back to normal as far the cashless policy is concerned.”

Further findings by The PUNCH confirmed the CBN would begin to release the old notes into circulation by Thursday. It was also gathered that banks would begin to pay their customers the old notes immediately to ensure the cash circulate across the country.

According to reliable sources in the CBN, banks have been also been directed to report to the old offices to collect the old naira notes they deposited with the apex bank.

They noted that before the end of the week, the country would be awash with naira notes.

Meanwhile, a top source close to the CBN said the apex bank took the decision to avert the planned picketing of the CBN offices nationwide by supporters and leaders of the Nigeria Labour Congress.

NLC protests

Earlier, The PUNCH had gathered that the NLC would on Wednesday picket the CBN headquarters and state offices in protest against the lingering naira crisis and fuel scarcity in the country.

The NLC President, Joe Ajaero, who disclosed this at a press conference on Wednesday, lamented that people’s hardships over the naira crisis had worsened.

The union had penultimate Monday issued a seven-day ultimatum to the Federal Government to address the scarcity of naira notes and fuel which had compounded the hardships being faced by Nigerians.

Though the CBN said then that it had complied with the Supreme Court judgment which directed that the old N200, N500 and N1000 notes should remain legal tender till December 31, banks have continued to ration the amount of cash issued to customers, indicating that they have not received cash supplies from the apex bank.

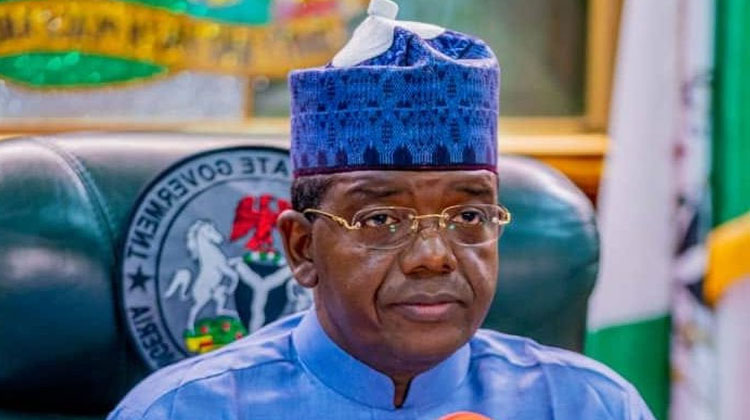

The three states of Kaduna, Kogi and Zamfara which sued the Federal Government over the naira redesign policy had threatened to file contempt charges against the Attorney-General of the Federation, Abubakar Malami, SAN and the CBN governor, Emefiele for not fully complying with the Supreme Court judgment.

Speaking at a press briefing in Abuja on Wednesday, Ajaero said the planned picketing of CBN offices became imperative following the apex bank’s failure to comply with the one-week ultimatum given to it to make cash available for Nigerians.

Ajaero explained that the union took the decision when it noticed that the situation appeared to be getting worse despite the Supreme Court order allowing the old N500 and N1000 notes to circulate with the new notes till December 31.

He directed all NLC’s affiliate unions and their state councils to begin mobilisation on Friday for the nationwide mass action, saying the Federal Government and the CBN have not shown any commitment to address the situation.

Giving an update about the ultimatum at the briefing which was held at Labour House, Ajaero said workers could no longer access cash to pay fares to their respective workplaces or buy food for their families.

He said, “Last week at the end of our CWC (Central Working Committee) meeting, we gave a one-week ultimatum for the Federal Government to address immediately, among other issues, the issue of cash crunch that was caused by the policy. As of this morning when the CWC met again to review the situation, we discovered that not much improvement has been made.

“The situation is still almost the same. People are still buying our currency with our currencies. People no longer have access to the currency and the government seems to be very adamant about this. No moves have been made to reduce the suffering of Nigerians.

One-week notice

“Consequently, the CWC-in-session resolved to go into the process of actualising the one-week notice. From Friday, there will be a mobilisation of all state councils through a NEC meeting. All unions have already been directed to mobilise all their organs and their branches.

“By Wednesday, next week, all Central Bank of Nigeria offices nationwide will be picketed. All central banks from the CBN headquarters will be shut till further notice. Workers are directed to stay at home and join in the picketing exercise.

“We call on Nigerians to understand the circumstances we are operating in. People will be telling you about the political situation. The political situation is self-inflicted and the economic situation is worse than the political situation because people cannot eat.”

The labour leader described the proposed demonstration as “total”, saying the workers have been pushed to the wall.

He added, “Workers can no longer go to the office and nothing is happening. So, we have been pushed to the wall having given one week (ultimatum) and we thought they could address the situation which is not addressed.

“We have decided to take our destiny into our hands. So, comrades, the mobilisation commences immediately and when we talk of action from Wednesday, it’s total; until further notice.’’

The labour leader explained that the lingering fuel scarcity and cash crunch were important issues for the NLC as they affected every Nigerian.

The Secretary-General of the National Union of Aviation Transport Employees, Ocheme Abah disclosed that the unions would comply with the NLC’s directive on the picketing action.

Responding to inquiries from The PUNCH, he said,” Yes, of course, we will comply as NLC directed. Yes, all the unions in all airports.

Meanwhile, the acting Director of Corporate Communications at CBN, Dr Isa Abdulmumin, said he could not immediately comment on whether the CBN would be releasing the old notes to commercial banks.

He said the apex bank would communicate its position on the matter on Thursday.

Punch