An economist, Dr Ayo Anthony says the new monetary policy by the Federal Government may help reduce Nigeria’s inflation rate in the long term.

Anthony said this in an interview with the News Agency of Nigeria (NAN) on Sunday in Abuja.

He spoke against the backdrop of President Muhammudu Buhari’s national broadcast on Thursday.

NAN recalls that the president in his message on The Challenges of the Currency Swap and State of The Nation, said one of the things the monetary policy would achieve in the short to medium and long terms, was to reduce inflation.

According to the president, in the short to medium and long terms, it is expected that there will be a lowering of inflation as a result of the accompanying decline in money supply that will slow the pace of inflation.

The economist, however, said in the short and mid-term, the policy may not reduce the inflation rate.

According to him, in the long run, the policy may work and may help reduce the inflation rate If and only if inflation in Nigeria is a monetary issue.

“For example, according to the statistics released, the CBN says about N3 trillion is the money in circulation, that is what you call money in supply.

“But out of the so-called N3 trillion in circulation, more than 60 per cent of it is not in circulation and still prices of goods are going up.

“More than 60 per cent of this money is not driving demand which means it is not in the banking sector.

“If money is driving demand, you can say money is the cause of inflation.”

Anthony, therefore, said that the current inflation in Nigeria was not an issue of excess money in supply driving demand.

“So, currency redesigning may not in the short run address the inflation problem, because what is the essence of redesigning?

” It is to bring in money outside the banking sector into the banking system, it is to bring in money people have kept outside transaction into transaction.

“So if this money eventually comes into transaction, and other fiscal policy measures are not put in place, it may even drive inflation higher, because more money will now be chasing fewer goods.”

The economist, however, said the short and intermediate solution to inflation in Nigeria was to remove the bottleneck in aggregate supply.

Anthony said that supply was the major cause of inflation in Nigeria, saying there was no adequate supply.

“That is why I said earlier that in the long run, this monetary policy may work because eventually if this money that is outside the banking vault comes in, definitely it will be available for suppliers.

He said if the money was available for suppliers, it may also move the price interest rate down, meaning that in the long run, Nigerians would see the positive impact of the naira redesign.

“But in the short run and intermediate-term, it may not lead to a reduction in inflation because inflation in Nigeria is not a monetary phenomenon as I said, it is a supply-side issue.

“When you say supply side, that is factors that affect aggregate supply like exchange rate, energy, and cost of production, these are the supply side.

“The cost of production in Nigeria is high. Tell me something in Nigeria that does not have an element of importation. With an exchange rate of about N700 per dollar.

“So with this type of exchange rate, definitely the producer will be constrained in producing more because they do not have access to dollars at a price that is friendly to production.

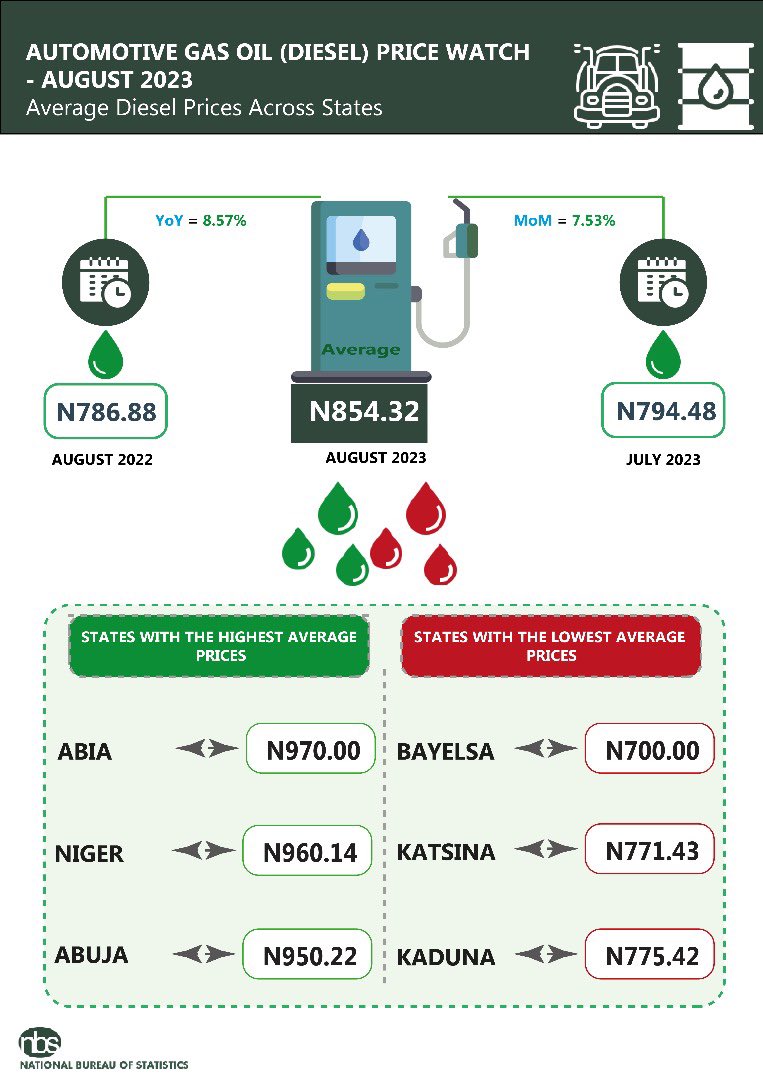

Anthony said that on the energy supply side, most industries and factories used diesel as a source of power, which was now very expensive and on a steady increase every month.

He said the effect of this was an increase in the price of goods and services the companies were producing.

The economist also said insecurity was a supply-side factor, saying that the Russia-Ukraine war was affecting supply as well.

“So when I say supply, it is a multidimensional factor, we have internal and external factors.

” The war in Ukraine is more external, but the foreign exchange is more internal and external; energy cost is more internal and insecurity is more internal.”

He said until these factors were addressed, Nigerians may not see any sign of price stability because inflation ideally was being influenced by two forces, demand and supply.

“The demand side is more money, when there is money, people will demand but when there is no money people won’t demand.

“Now, there is no money in Nigeria, look at this cashless issue, do not be surprised inflation may come down slightly because people are not buying.

“Suppliers may be forced to reduce their prices to induce buyers to buy. But mind you, they cannot reduce prices beyond their profit margin.”

NAN reports that the latest report from the National Bureau of Statistics (NBS) shows that Nigeria’s headline inflation rate increased to 21.82 per cent on a year-on-year basis in January 2023.

(NAN)